- Credit Restoration Experts Nationwide

The Credit Report Revealed – Part II

June 27, 2017

Sample Credit Report

June 27, 2017What Is The Difference Between A FICO Score and A Vantage Score?

Just a few years ago, the three major credit reporting agencies (bureaus)…Experian, TransUnion, and Equifax…got together and decided to challenge the FICO score model. They were intent on coming up with their own scoring model that would break down the criteria even further. This would allow them to sell more kinds of data to creditors. Their idea was to provide more consistency and predictability in credit scoring, especially for consumers that had a “thin file” (those just starting out in the credit world).

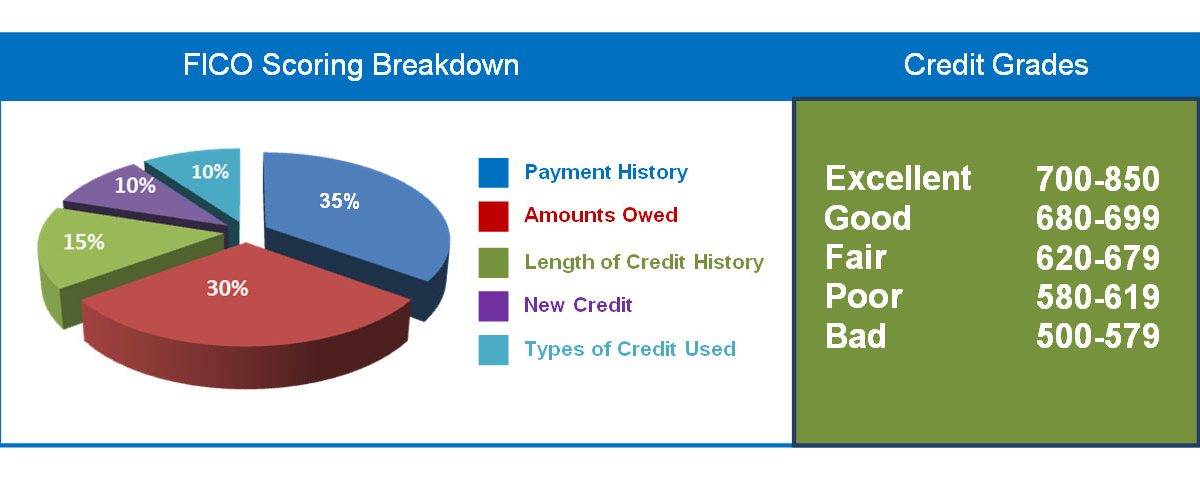

The FICO model ranges between 300-850 for consumer files. The Vantage Score ranges between 500-990.

FICO Model Vantage Model

Excellent 700-850 “A” 900-990

Good 680-699 “B” 800-899

Fair 620-679 “C” 700-799

Poor 580-619 “D” 600-699

Bad 500-579 “F” below 599

As you can see, the FICO model is graded kind of like when we were in school…on a curve. The high scores are given so much more weight than the lower scores. In the Vantage Model, there is no curve…it is a straight 90-100 point difference between levels.

While the Vantage score may or may turn out to be more equitable for consumers, at this writing, lenders are still overwhelmingly using the FICO standard. As a consumer, however, it is important for you to ask the question of your lender…which scoring model are you using? Additionally, how does a consumer find out which score is being used when he obtains his annual free report, or if he is paying for a monthly service? It is important to ASK the question.